India's banking sector is witnessing explosive growth, marked by the rapid emergence of neobanking platforms. Neobanks represent a new wave of banking institutions that prioritize digital-first experiences. These are sleek, mobile-first banks operating without the traditional brick-and-mortar infrastructure. 811 by Kotak, Digibank by DBS, Freo, Niyo, Open, and RazorPayX are a few of the leading neobanks in India today.

These modern financial institutions are reshaping the traditional banking scene by utilizing cutting-edge technology and bringing more accessible, efficient, and customer-centric banking solutions to people.

In the Indian neobanking market, the number of users is expected to amount to 21.75m by 2028, and the transaction value is expected to show an annual growth rate (CAGR 2024-2028) of 14.61%.

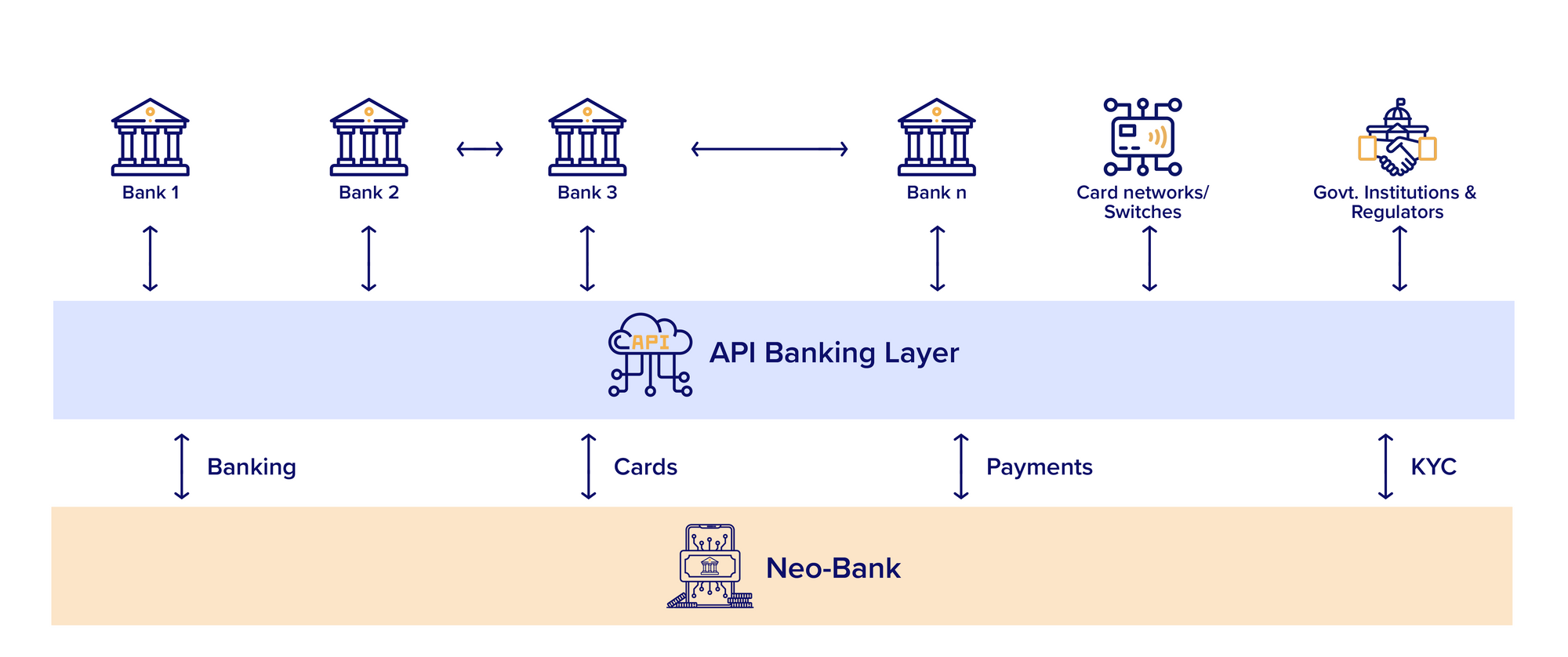

APIs are at the heart of neobanking's success. These are the basic parts of modern banking, allowing these banks to easily work together with various financial services. This ability to connect so well is key to how neobanks can quickly develop new and varied products and services that meet the specific wants and needs of today's online customers.

How APIs enable neobanking

Neobanks harness the power of APIs to create a smooth, integrated financial network. This network enables a wide array of services, ranging from simple tasks like opening an account and managing funds to more sophisticated operations including loans, investments, and personalized financial advice. APIs serve as the bridge between neobanks and other financial institutions or applications. Through these connections, neobanks can offer their customers comprehensive access to the financial ecosystem, allowing for real-time transactions, data sharing, and a seamless user experience across various platforms. This infrastructure not only facilitates the rapid deployment of innovative financial products but also enables neobanks to customize services according to individual user needs, enhancing customer satisfaction and engagement in the digital age.

Types of APIs commonly used by neobanks

- Payment gateways APIs

Payment gateway APIs enable the processing of online transactions securely and efficiently. They connect neobank platforms with payment networks, enabling users to perform transactions without the need for traditional banking infrastructures. This includes not only transferring money but also facilitating real-time payments and supporting various payment methods. - Customer Verification APIs

Neobanks use customer verification APIs to comply with regulatory requirements and prevent fraud. These APIs automate the identity verification process by checking provided customer data against official databases, ensuring quick and reliable verification. This process is vital for the Know Your Customer (KYC) procedures, enabling neobanks to swiftly onboard customers while maintaining high compliance and security standards. - Data aggregation APIs

Data aggregation APIs gather financial information from various sources into a single platform, offering a comprehensive view of a customer's financial status. This includes aggregating data from multiple bank accounts, credit cards, loans, and investment accounts. For customers, this means receiving personalized financial insights and advice based on their complete financial picture, enabling better financial decision-making. - Credit scoring APIs

These APIs analyze customer financial data to assess creditworthiness quickly and accurately. By evaluating factors such as income, spending habits, and existing debts, credit scoring APIs help neobanks offer personalized loan products and credit offers, making the lending process more efficient and accessible. - Investment and wealth management APIs

These enable neobanks to offer investment services directly within their apps. They can integrate with stock exchanges, mutual fund companies, and other investment platforms, allowing customers to buy, sell, and manage investments. Wealth management APIs also provide financial advisory services, portfolio management, and personalized investment advice, catering to the diverse investment needs of customers. - Fraud detection APIs

Fraud detection APIs use advanced algorithms and ML to identify and prevent fraudulent transactions in real time. They monitor transactions for unusual patterns that may indicate fraud, helping protect both the neobank and its customers from financial losses and enhancing security. - Currency exchange and international transfer APIs

For neobanks catering to customers who travel frequently or conduct business internationally, these APIs provide real-time currency conversion rates and enable seamless cross-border payments and transfers. They help minimize fees and offer competitive exchange rates, making international transactions more cost-effective. - Regulatory compliance APIs

Given the complex regulatory environment in which neobanks operate, compliance APIs are essential for ensuring adherence to legal and regulatory requirements. These APIs can automate reporting processes, monitor transactions for compliance with anti-money laundering (AML) and counter-terrorism financing (CTF) regulations, and help manage risk. - Account aggregation APIs

While similar to data aggregation, account aggregation APIs allow users to view all their accounts from different financial institutions in one place. This holistic view supports better financial management and planning by providing insights into spending, savings, and investment accounts across multiple platforms.

By integrating these diverse APIs into their platforms, neobanks can offer a broad spectrum of financial services tailored to the modern consumer's needs. This comprehensive approach not only enhances customer satisfaction but also positions neobanks as competitive alternatives to traditional banking institutions.

How APIs are paving the way for neobanks

Offering innovative and user-friendly financial products

Rapid product development: APIs allow neobanks to quickly develop and deploy new financial products by providing pre-built functions and services. This accelerates the product development cycle, enabling neobanks to respond swiftly to market demands or regulatory changes.

Diverse financial offerings: By leveraging APIs from various fintech and financial service providers, neobanks can offer a wide range of products, from traditional banking services like savings and checking accounts to more complex products like loans, insurance, and investment opportunities, all within their platforms.

User-centric design: The flexibility offered by APIs means that neobanks can focus on user experience (UX) design, making financial products not only accessible but also engaging for the user. This includes intuitive interfaces, simplified processes, and interactive financial tools.

Integrating seamlessly with third-party applications and services

Ecosystem connectivity: APIs act as the glue between different software applications, allowing neobanks to easily connect with third-party services. This ecosystem connectivity enables users to access a variety of financial services, such as payment processing, financial management tools, and e-commerce platforms, directly from their banking app.

Streamlined operations: Integration with third-party applications via APIs leads to more efficient operations, as neobanks can automate various processes like transactions processing, customer support, and even regulatory compliance. This efficiency not only reduces costs but also improves the speed and reliability of services.

Open banking: APIs are at the heart of the open banking movement, which encourages the sharing of financial data (with customer consent) among financial institutions and third-party providers. This facilitates the creation of innovative financial services and products, fostering competition and collaboration within the financial ecosystem.

Personalizing banking experiences for customers

Data-driven insights: By utilizing APIs to aggregate and analyze customer data, neobanks can gain deep insights into individual financial behaviors and preferences. This information allows them to offer tailored advice, personalized product recommendations, and customized financial solutions.

Dynamic customer engagement: APIs enable the delivery of real-time notifications, financial updates, and personalized messages through various channels, enhancing customer engagement and satisfaction. This dynamic communication helps neobanks to maintain a continuous relationship with their customers, adapting services to their evolving needs.

Enhanced security and trust: Personalization also extends to security, where APIs are used to implement advanced authentication methods (like biometrics) and customize security protocols based on individual risk profiles. This not only protects customers but also builds trust by demonstrating a commitment to safeguarding personal and financial data.

Expanding accessibility

Global services: Through currency exchange and international transfer APIs, neobanks can offer global banking services, making it easier for customers to manage finances across borders without hefty fees or unfavorable exchange rates.

Financial inclusion: APIs also play a crucial role in extending financial services to underserved or unbanked populations. By simplifying the banking process and reducing operational costs, neobanks can reach a wider audience, providing access to financial services that were previously inaccessible.

Overcoming API integration challenges in neobanking

While transformative, integrating APIs into neobanking operations introduces several challenges ranging from security concerns to regulatory compliance and the need for standardization. Here’s how these challenges manifest and potential strategies for overcoming them:

Security concerns

As APIs open pathways between different systems, they inherently increase the risk of data breaches and cyberattacks. The financial sector, given its sensitivity, becomes a prime target for such threats, raising concerns over customer data protection and financial security.

Solutions:

Implement robust authentication and encryption: Utilizing strong authentication mechanisms (like OAuth 2.0) and ensuring all data is encrypted in transit and at rest can significantly mitigate security risks.

Regular security audits and penetration testing: Conducting comprehensive security assessments and testing can identify and address vulnerabilities before they can be exploited.

API gateway: Employing an API gateway can provide an additional layer of security, offering capabilities like rate limiting, threat detection, and API activity monitoring.

Regulatory hurdles

Challenge: Neobanks operate in a highly regulated environment where compliance with financial regulations is non-negotiable. The dynamic nature of APIs, coupled with varying international regulatory standards, complicates compliance efforts. Solutions:

Regulatory Technology (RegTech): Leveraging RegTech solutions can help manage compliance more efficiently through automation, real-time reporting, and regulatory data management.

Collaboration with regulators: Engaging in ongoing dialogue with regulatory bodies to understand requirements and develop compliant API strategies is crucial. Participating in regulatory sandboxes can also provide insights and guidance.

Compliance-by-design: Integrating compliance into the API development process ensures that regulatory requirements are considered at every stage, reducing the risk of non-compliance.

Need for Standardization

The lack of standardization across APIs can lead to interoperability issues, making it difficult for neobanks and third-party providers to integrate seamlessly. This can hinder the development of new services and limit consumer choice. Solutions:

Adopt industry standards: Embracing existing API standards (such as the Open Banking standards in the UK) can promote interoperability and ease integration challenges.

Participation in standardization initiatives: Actively participating in or contributing to industry consortia and standardization bodies can help shape the development of API standards that benefit the entire ecosystem.

Open API initiatives: Promoting open APIs, where documentation and specifications are made publicly available, encourages standardization and fosters a more collaborative and innovative industry environment.

Key API best practices for neobanking success

- Continuous monitoring and improvement: Regularly reviewing API security, performance, and compliance postures to adapt to evolving threats and regulatory changes.

- Educate and train staff: Ensuring that employees understand the importance of security and compliance and are trained in best practices is vital for maintaining a secure and compliant API ecosystem.

- Customer transparency: Keeping customers informed about how their data is used and protected builds trust and reinforces the bank’s commitment to security and privacy.

Conclusion

APIs represent a cornerstone of innovation in the neobanking sector, enabling these digital banks to offer a wide range of efficient, personalized, and secure financial services. However, navigating the landscape of API integration presents its own set of challenges, from ensuring robust security measures to maintaining regulatory compliance and standardization. By addressing these issues head-on with strategic solutions and best practices, neobanks can not only mitigate risks but also unlock the full potential of APIs to revolutionize the banking experience. As neobanks continue to evolve, their ability to overcome these challenges will be pivotal in shaping the future of financial services, making banking more accessible, flexible, and user-centric than ever before.