Have you ever wondered how seamlessly your favorite budgeting app connects with your bank account to track your spending? Or how swiftly do your online purchases get approved when using your credit card on e-commerce platforms?

Not long ago, leaving the house without cash and cards seemed unimaginable. Today, our smartphones are all we need, even for a world tour. This leap into the future, thanks to the fintech revolution, is powered at its core by the unsung heroes - open banking APIs. Quietly operating in the background to ensure the efficiency and security of your financial transactions, open banking APIs are opening up new possibilities for fintech innovation every day.

The fintech boom: India's financial revolution

India's financial landscape is witnessing a revolution, with the fintech adoption rate at 87%, significantly higher than the global average of 64%. In FY 2022, over 72 billion digital transactions were recorded, and digital lending platforms experienced a 3X increase in disbursals. These figures are expected to grow in the coming years, boosted by the collaboration of fintech companies and traditional banks, especially by using open APIs.

The Indian fintech industry, the 3rd largest in the world, is a vibrant ecosystem fueled by 3000+ recognized startups. As financial institutions in India deepen their collaborations and harness the potential of open banking APIs, the Indian fintech landscape is poised to become a global leader in financial technology.

This blog delves into the impact of open banking APIs on the Indian fintech landscape. We'll explore how these APIs foster a collaborative ecosystem, unlocking benefits for customers, fintech companies, and traditional financial institutions.

Understanding open banking APIs

Open APIs are sets of rules and protocols that enable different software applications to communicate and exchange information with each other. In finance, these APIs are called open banking APIs.

They enable third-party developers to access a bank's data and services in a secure and controlled way. This can include checking account balances, making payments, or gathering financial information, all with the customer's permission.

Open banking APIs aim to foster innovation, improve customer experiences, and increase competition in the financial sector by providing more choices and better services

Open banking APIs facilitate two key functions:

Data sharing

They act as secure tunnels, allowing controlled access to specific data and services between institutions. For example, when you apply for a loan online, an open banking API can securely send your financial details, like income and transactions, from your bank to the lender without needing manual paperwork. This makes the loan process quicker and easier.

Integration

They help third-party developers and companies to integrate various financial services seamlessly with their software. For instance, booking a flight online involves searching, selecting, and paying. Open banking APIs enable travel apps to integrate with payment gateways for secure transactions and even insurance providers for travel protection, all within a single app.

India's open banking APIs

India's open banking APIs, launched in 2018 by the Reserve Bank of India (RBI), emphasize financial inclusion and innovation. Key features include:

- Interoperability: Ensuring different banking and financial systems can work together seamlessly.

- Security and privacy: Strong emphasis on data security and user privacy, with strict guidelines on data sharing consent.

- Unified Payments Interface (UPI): A system that allows instant money transfers and payments through mobile numbers or virtual payment addresses.

- Account Aggregator (AA) framework: A consent-based data-sharing model that enables individuals and small businesses to share their financial data with third parties securely.

Types of open APIs in banking

Various APIs play critical roles across different financial services in India's evolving open banking landscape. Here's a concise overview of the key types:

As per the State of the Fintech Union 2023 report by BCG, open API connectivity is one of the key technology frontiers that will shape the future of fintechs in India.

Driving forces behind the rise of open banking APIs

The rise of open banking APIs in India can be attributed to multiple factors. The key ones are:

Government initiatives and regulations

India Stack: Launched as a part of the Digital India campaign, India Stack is a unified platform designed to leverage India's digital infrastructure to promote more inclusive financial services. It includes Aadhaar for identity verification, UPI for financial transactions, and the DigiLocker for document storage. These components are built on open APIs, facilitating seamless data flow and interoperability across services.

RBI regulations: The Reserve Bank of India (RBI) has proactively regulated the financial sector to promote innovation while ensuring security and privacy. RBI guidelines mandated standardized APIs for account access, payment initiation, and data aggregation. This regulatory push has boosted adoption and fostered a level playing field for both established players and fintech startups.

Rising demand for customer-centricity

Indian consumers, and millennials and Gen Z users in particular, increasingly seek personalized, tech-enabled financial experiences. Open APIs allow fintech companies to develop innovative solutions catering to specific needs and preferences, driving financial inclusion and engagement.

Digital adoption surge

Increased smartphone penetration and internet usage fuel the demand for convenient, digital-first financial services. Open APIs unlock seamless integration with popular apps and platforms, creating a frictionless user experience.

Competitive pressure on traditional banks

Agile fintech startups leverage open APIs to offer faster, more user-friendly alternatives, challenging traditional banks' market share. This pressurizes banks to embrace open APIs and develop their own innovative offerings.

Collaboration opportunities

Open APIs enable collaboration between banks and fintech companies, allowing them to pool resources and expertise to develop new services and improve operational efficiency.

Solutions and use cases enabled by open banking APIs

Open banking APIs have catalyzed many innovative solutions and use cases in India, fundamentally transforming the financial services landscape. Here are key examples demonstrating the power and versatility of open banking in action:

Real-time payments and settlements

Open banking APIs underpin the Unified Payments Interface (UPI), enabling instant peer-to-peer and merchant transactions. This has revolutionized payments in India, allowing users to make real-time transfers 24/7, directly from their bank accounts, using a mobile number or virtual payment address.

Personal financial management

By leveraging Account Information Service (AIS) APIs, fintech apps can provide users with a consolidated view of their finances across multiple accounts. This includes spending tracking, budgeting tools, and personalized financial insights, helping consumers make informed decisions and improve their financial health.

Simplified lending and credit scoring

Integrating open banking APIs with the Account Aggregator (AA) network enables lenders to access borrowers' financial information (with consent), streamlining the loan approval process. This facilitates quicker, more accurate credit assessments, and personalized loan offers, reducing the paperwork and time typically required for loan applications.

Enhanced customer onboarding

Open banking APIs expedite the Know Your Customer (KYC) process, allowing banks and financial institutions to verify the identity of new customers quickly. This digital onboarding process reduces the need for physical documentation, making it faster and more convenient for both service providers and consumers.

Wealth management and investment services

Through open banking, investment platforms can offer services like direct mutual fund investments, stock trading, and real-time portfolio management. APIs enable these platforms to access market data, execute transactions, and provide personalized investment advice based on the user's financial data and goals.

Insurance policy management

Open APIs allow insurance providers to offer streamlined services such as policy comparison, purchase, and management directly through banking and fintech apps. Customers can manage their policies, file claims easily, and receive payouts more efficiently, enhancing the overall insurance experience.

Merchant services and business solutions

For businesses, open APIs facilitate services like automated invoicing, access to credit, and real-time financial insights. These tools help Small and Medium Enterprises (SMEs) better manage their finances, plan for growth, and improve operational efficiency.

These solutions and use cases are just the tip of the iceberg, showcasing the transformative potential of open banking APIs in India. As newer technologies, like Generative AI, emerge, the fintech sector is set to offer even more advanced and innovative solutions.

Benefits of open banking APIs collaboration in India's fintech landscape

For customers

- Improved service offerings: Open banking fosters a competitive environment that constantly pushes financial institutions to enhance their offerings to meet increasing consumer demands. This competition leads to a wider selection of innovative financial products, more intuitive interfaces, and better customer experiences. Innovations like digital wallets, improved payment gateways, and decentralized finance illustrate the transformative impact open banking can have on user experiences.

- Frictionless transactions: These APIs facilitate quicker and more convenient transactions by enabling direct, secure communication between banking systems and third-party applications. Customers benefit from reduced waiting times, fewer steps to complete transactions, personalize services, and enhanced security.

- Wider access to financial products: Open banking APIs break down barriers between traditional banks and innovative fintech players. This means access to a broader range of financial products, potentially including microloans, alternative credit scoring, and wealth management solutions tailored to underserved segments.

For fintech companies

- Faster innovation: By leveraging pre-built APIs and established infrastructure, fintech companies can focus on developing niche solutions and bringing them to market quickly. This fosters a more dynamic and competitive landscape, ultimately benefiting customers with more choices.

- Access to wider customer base: Open banking APIs allow fintech companies to tap into the customer base of established institutions, expanding their reach and potential to acquire new users. This collaboration model helps them leverage existing trust and brand recognition without building everything from scratch.

- Focus on niche expertise: Freed from the need to build extensive technology infrastructure, fintech companies can concentrate on their core strengths and specialize in specific areas like micro-investing, peer-to-peer lending, or financial literacy tools. This contributes to a more diverse and specialized financial ecosystem.

For banks

- Enhanced efficiency: Open APIs automate manual processes like data exchange and verification, reducing operational costs and streamlining operations. This allows banks to allocate resources towards developing better customer experiences and innovative offerings.

- Revenue generation through partnerships: By partnering with fintech companies, banks can access new markets, customer segments, and revenue streams. They can co-create innovative products and services, leveraging the agility of fintechs and their own established presence.

- Improved customer engagement: Open APIs enable banks to offer personalized financial insights and recommendations within various customer touchpoints, leading to deeper customer engagement and brand loyalty. This can also help them compete effectively against emerging fintech players.

BHIM UPI success story - The Power of open banking and fintech

Developed by the National Payments Corporation of India (NPCI), BHIM UPI is a revolutionary platform that leverages open APIs to facilitate instant payment transfers between banks using mobile devices. Launched in 2016, UPI has significantly transformed the digital payments landscape in India.

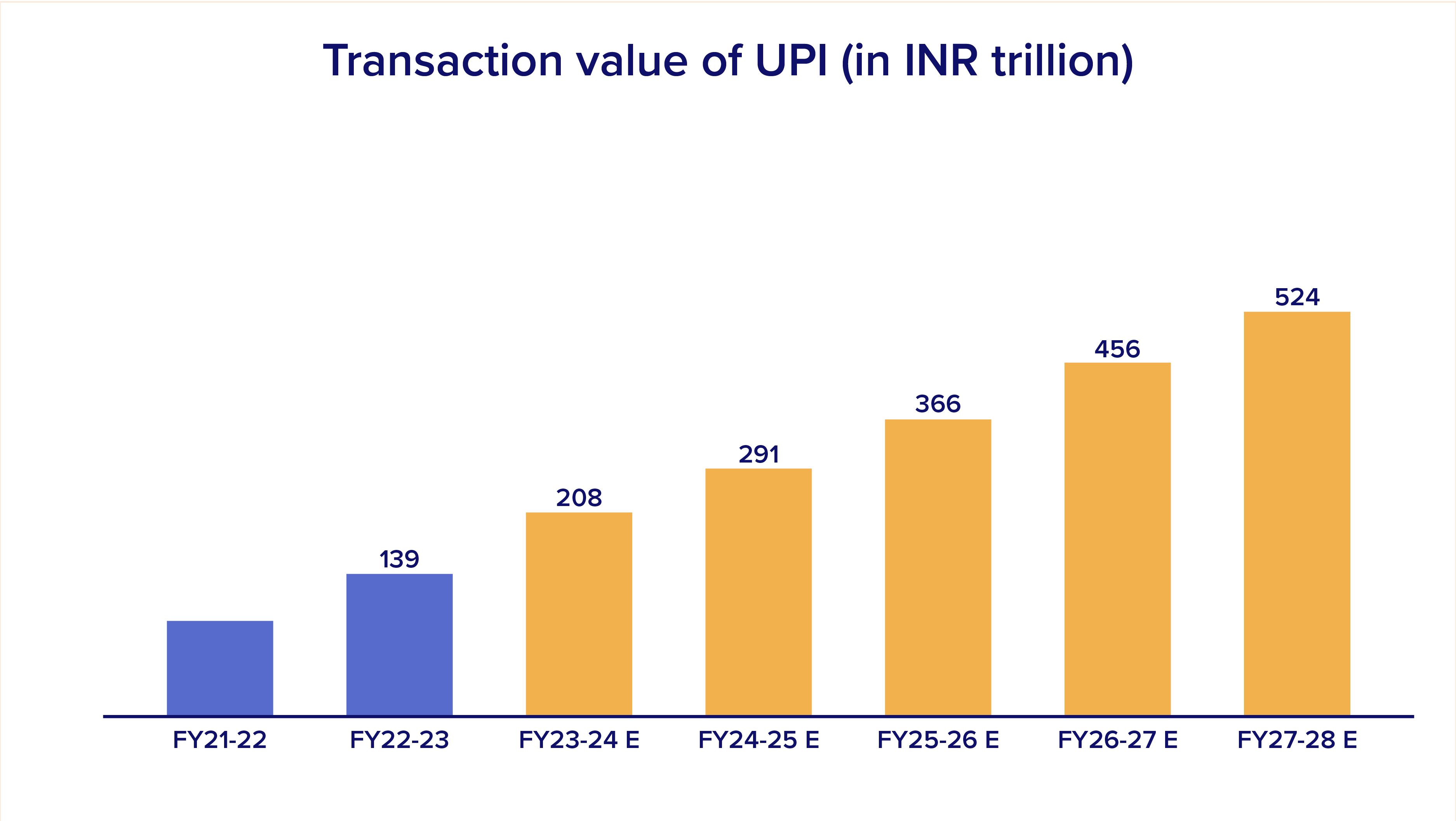

As reported by NPCI, since its launch, UPI has expanded the digital payment pie by more than seven times. The UPI accounted for 75% of retail digital transactions in the country during 2022-23 and is expected to record 1 billion transactions per day by 2026-27.

UPI has democratized access to digital payment solutions, reaching rural and semi-urban areas and contributing to financial inclusion. The open API architecture of UPI has enabled the development of numerous third-party payment apps, fostering innovation and competition in the fintech sector.

BHIM UPI's success highlights how open banking and fintech are making finance easier and more accessible for everyone.

Challenges and considerations for open banking APIs

While open banking APIs unlock immense potential, there are certain challenges and considerations to ensure they promote sustainable growth:

Data security and privacy

Open APIs necessitate data sharing, raising concerns about user privacy and security. Robust measures are required to ensure comprehensive data protection frameworks, user consent mechanisms, and stringent security protocols to mitigate unauthorized access and breaches.

Standardization and interoperability

To unlock the full potential of open banking, consistent API standards and seamless interoperability between various platforms are crucial. This requires ongoing collaboration between stakeholders, including regulators, financial institutions, and fintech players, to define and enforce unified standards. This G20 report on improving global financial inclusion stresses on API standardization as the key factor in improving interoperability.

Regulatory compliance and evolving frameworks

The regulatory landscape surrounding open banking is constantly evolving. To avoid legal and operational risks, stakeholders must stay abreast of these changes and comply with relevant regulations. This necessitates continuous adaptation and agility within the ecosystem.

The Future of open banking APIs in Indian fintech

The number of open banking users worldwide is forecast to reach 132.2 million by 2024. The evolution of open banking APIs in India's fintech sector is poised for transformative changes fueled by technological advancements and a growing emphasis on user-centric financial solutions. As the landscape evolves, the integration of cutting-edge technologies like AI and blockchain is set to redefine how financial services operate, emphasizing personalized services, enhanced security, and greater transparency:

Enhanced personalization with AI

The application of Artificial Intelligence (AI) in analyzing vast amounts of user data through open banking APIs promises unprecedented levels of personalization. Financial institutions can offer tailored financial advice, predictive analytics for spending and saving, and customized product recommendations. This level of personalization not only enhances user experience but also aids in precise risk assessment and financial planning, marking a shift towards more intelligent and responsive financial services.

Blockchain for trust and security

Incorporating blockchain technology with open banking APIs can significantly bolster the security framework of digital transactions. Blockchain's inherent characteristics—decentralization, immutability, and transparency—ensure secure and transparent data sharing. This can facilitate the creation of a more reliable ecosystem for financial transactions, reducing fraud and enhancing trust between parties. Moreover, blockchain can simplify compliance with regulatory requirements, offering a streamlined approach to data privacy and security.

Wider financial inclusion

Open banking APIs are pivotal in democratizing access to financial services, reaching underserved and unbanked populations. By enabling third-party developers to create innovative financial solutions, open banking has the potential to bridge the gap in financial inclusion, offering a range of services from micro-loans to insurance products tailored to the needs of diverse consumer segments.

Cross-border payments

The global nature of blockchain combined with open banking APIs can revolutionize cross-border payments, making them faster, cheaper, and more accessible. This can significantly benefit businesses and individuals by reducing the costs and complexities associated with international transactions, fostering a more interconnected global economy.

Growth-supportive regulatory compliance

The regulatory environment in India is evolving to support the growth of open banking, with frameworks aimed at protecting consumer data while promoting innovation. This balance is crucial for fostering a healthy fintech ecosystem that is both innovative and secure, ensuring that the benefits of open banking reach a wide array of users without compromising safety and privacy.

Conclusion

As India continues to embrace digital transformation in its financial sector, the future of open banking APIs holds great promise. The Indian fintech industry is well-positioned to lead in innovation, security, and financial inclusion, setting a benchmark for the global financial ecosystem. By fostering a culture of collaboration and technological advancement, India can unlock new opportunities for growth and customer satisfaction. Moreover, as regulatory frameworks evolve to support these initiatives, the pathway for more accessible, efficient, and secure financial services becomes increasingly clear, further solidifying India's role as a fintech powerhouse on the world stage.