- Banking-as-a-Service (BaaS) is one of the fastest-growing FinTech sectors and is changing the way banks operate.

- BaaS providers act as intermediaries between banks and FinTech. By offering financial services to users, BaaS providers help empower end-users to take control of their finances by offering them more flexible banking options.

- Banking-as-a-Service is an ecosystem with multiple components and industry leaders, each with different regulatory requirements. While each of these players should have access to banking data, privacy and security are paramount to keeping these consumers happy.

What is Banking-as-a-Service?

- Uber and the State bank of India partnered to provide vehicle finance to drivers.

- Razorpay and RBL Bank have collaborated to simplify digital merchant onboarding and payment solutions.

- E-commerce giants like Snapdeal and Freecharge providing "instant refunds" by partnering with Yes Bank

To make these collaborations possible, banks must open up their data and technology to external parties. This phenomenon is known as the Banking-as-a-Service (BaaS) model.

To help understand how banking-as-a-service works, we will use an analogy. Imagine you're the manager of a cab company. You're facing stiff competition and want to grow your customer base. If you could offer your customers a debit card, you'd be able to give them points that they can redeem on your application.

Then, you could tailor your customer service to each customer’s spending behavior. You could analyze how customers use their credit cards and personalize your services to them through text messages, emails, and interactive touchpoints.

There are dozens of ways for any business or non-banks to gain more revenue by offering their own banking services. But if you want to offer banking services – you must have a banking license. And this is where banking-as-a-service can really help. Firms have long asked for banking services, but they are often too expensive or aren't compliant with international banking regulations. BaaS allows companies to offer banking products and services at a fraction of the cost compared to traditional banking without a banking license.

What is BaaS?

Banking-as-a-Service describes the unbundling of banking infrastructure and the ability to have access via APIs to specific banking functions.

These APIs and the information they provide can be utilized by FinTechs or any other third-party developers running a digital platform to build new consumer-facing and enterprise-facing financial solutions.

Banking-as-a-Service or BaaS describes an approach in which banks provide financial services through applications built on top of their APIs. The popularity of BaaS is because it allows businesses and consumers to reap the benefits of modern banking without having to physically engage with a bank.

This opens up the possibility for a non-bank business, such as your cab company, to offer digital banking services like mobile bank accounts, debit cards, and loans without acquiring a banking license.

The bank’s system communicates with the cab company via APIs and webhooks, making their customers’ accounts directly accessible via the cab company website or app. Rather than acting as a middleman between the customer and their financial institution, the cab company is merely an intermediary, meaning it is not burdened by any of the regulatory duties of a bank.

Thus, with banking-as-a-service, pretty much any business can become a bank. With the power of the cloud, an entire bank can be built on a single line of code. The business is in control of its own financial services infrastructure without having to invest in excessive systems and staff. This is also known as white-label banking since the banking service is delivered through the brand of the non-bank.

How Banking-as-a-Service works

Banking-as-a-Service has become a valuable and innovative solution in FinTech to deliver banking services in an agile and flexible way. The BaaS solution providers have demonstrated the ability to provide banking services through APIs that can be implemented and launched in a short time frame without large capital requirements or monetary licenses.

APIs are the building blocks of a digital banking core framework. They assemble into logical groupings that can be used to build functions such as creating and setting up accounts, withdrawals, deposits, and loans.

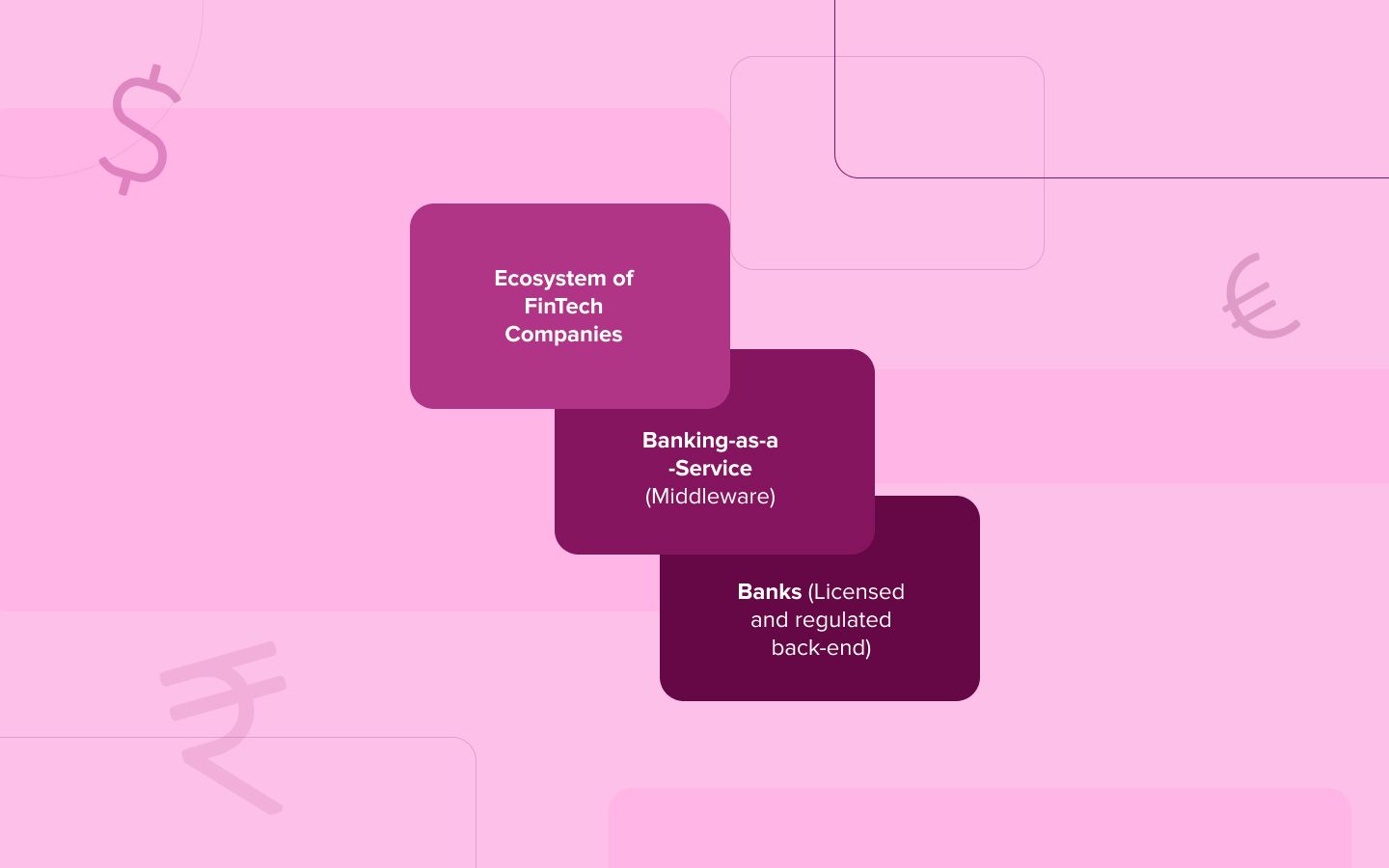

Here’s a detailed breakdown of the three-tier, API-based banking-as-a-service stack:

- The bottom level is a traditional, nationally licensed financial institution (bank) that collaborates with the BaaS provider, commonly known as the “Infrastructure-as-a-Service (IaaS) layer.”

- The "Banking-as-a-Service layer" in the middle depicts banking services that have been tailored as an environment for FinTech startups and other businesses to deliver products to end consumers. This stack element acts as a mediator between the bank and FinTech, sending data back and forth through the BaaS provider.

- The topmost layer is the FinTech company that receives data from customers about their transactions. It then shares that information with third-party BaaS providers. The BaaS providers, in turn, pass along the information to the FinTech layer received from the banks.

Tech companies that integrate banking services would have the ability to remove the layers of financial regulation. For example, Amazon Web Services obtained a banking license and now operates as a premier IaaS provider that also provides server hardware. This is a significant evolution in the banking sector and will change how clients interact with their banks.

BaaS is a proven model that enables banks and large financial institutions to deploy their core banking infrastructure at scale; however, the current model requires an intermediary. A more reliable and affordable solution would be to have banks build their own BaaS solutions. This would enable companies to plug into the core banking infrastructure without the need for a third-party provider to act as a middleman. Companies can create and sell products to customers directly using this new protocol, rather than using a separate product. With the new platform, they can offer a broader range of services to their customers and even tailor products like credit cards, loans, and insurance.

Related: What is FinTech? - APIs in FinTech, and FinTech Use Cases

Banking-as-a-Service players

(Credit: Business Insider)

There are two types of players in the BaaS ecosystem:

- FinTechs who give BaaS functionality to other companies in order for them to quickly grow their product portfolios – also known as Pure BaaS providers.

- Traditional banks that saw the upcoming trend and used APIs to offer up their banking services to other FinTech businesses. Banking-as-a-Service capabilities help these banks develop a hedge against tech competition and grow deposit share in broader market segments.

Banking-as-a-Service use cases

Card payment and processing

In today's digital economy, non-financial companies are leveraging banking-as-a-service to provide payment functionality to their platforms or apps. This allows these organizations to reduce their overhead costs as they don't need to develop and maintain their own payment infrastructure.

Identity verification

The banking industry is one of the fastest-moving sectors in the world. To combat high levels of fraud and identity theft, the industry is implementing stricter regulations. For example, with a BaaS provider, companies don’t have to worry about keeping up to date with new terms and regulations.

Increased fraud and identity theft is putting an enormous strain on businesses, which often results in the need to use more sophisticated identity verification solutions. By partnering with a BaaS provider, businesses don’t have to worry about implementing their own KYC solution or keeping up with new regulations. Instead, businesses can connect to a bank's KYC API, allowing clients to verify their identity quickly and affordably.

Lending

With more and more e-commerce sites competing for customers, and as online sales continue to increase, the only way to stand out is to offer a comprehensive service and help customers out. Lending is an incredibly powerful tool that can help small merchants compete with large e-commerce markets.

Enhanced customer experience

An integration of different services into a single platform is an excellent way for companies to improve their customer service abilities. By offering BaaS solutions, banks can grow their customer bases by integrating their delivery services to various companies from different industries.

Online banking services in an app

Some FinTech companies can provide personalized banking services and might even be able to start their own online-only banks. These startups can offer many of the same services as most brick-and-mortar banks but can do so in a way that's very different from traditional banks.

Is BaaS a fad?

Banking-as-a-Service (BaaS) has been a modern-day development trend for several years now. In 2012, Credit Agricole, a French bank, launched an API marketplace that allowed developers to access its data and services through their applications. Then, in 2013, Yes Bank and RBL Bank, two Indian banks, pioneered BaaS by creating APIs for their business data, which developers could use in their own apps.

Later, many major banks such as Citibank, JPMorgan Chase, Wells Fargo, and Barclays began providing APIs to developers. With current API offerings from private banks like HDFC, ICICI, and Kotak and recent BaaS FinTech startups like Zeta, Setu, and Yap, the API space is booming in India.

While formerly established banks were opening up their APIs and offering product innovation to startups, new challengers and neo-banks have established themselves with digital as core to their business. These challengers and neo-banks have emerged in the Indian retail banking space like Paytm and OPEN, offering a wide range of financial services for startups and small businesses.

How BaaS is transforming Indian financial services

While the COVID pandemic has dramatically impacted banking as we know it, it has also helped digital banking to gain rapid acceptance. Rapidly growing FinTechs in India are thriving and offering financial products that meet most consumers’ needs.

It seems like the government has hit the nail on the head with their current push to increase funding for digital initiatives. This is an excellent time for startups to enter the digital financial services space, and venture capital has been pouring into new digital banks like a waterfall. Traditional banks are losing customers to digital financial service providers. This is happening because digital financial services are more cost-effective, provide users with a better overall experience, and give them tools they cannot get from traditional banks.

However, we have also seen several success stories where traditional and emerging financial technologies have combined to create new products:

- Uber and the State bank of India partnered to provide vehicle finance to drives.

- Razorpay and RBL Bank have collaborated to simplify digital merchant onboarding and payment solutions.

- E-commerce giants like Snapdeal and Freecharge providing "instant refunds" by partnering with Yes Bank.

To make these types of collaborations possible, banks must open up their data and technology to external parties. This phenomenon is known as the Banking-a-as-a-Service (BaaS) model.

BaaS revolutionizing customer intimacy

BaaS, or “Banking-as-a-Service,” is a model for the banking industry that allows companies to avoid the heavy costs associated with traditional systems and focus on value creation. BaaS allows companies to streamline their banking needs by buying services from a third party and integrating them into an existing system. The benefits of this model go beyond the ability to monetize existing infrastructure or increasing customer reach.

Their focus was to improve the customer touchpoint with the banking system. In digital processes like digital account opening and loan origination, they had a hand in providing a better customer experience. The future of customer intimacy lies not in ensuring the customer has an account or mortgage but rather in providing a better customer experience that starts from wherever the customer needs it.

These examples show how banks in India are using BaaS to serve customers better.

Bajaj Finance, a leading personal finance company, collaborates with RBL to offer vehicle financing across India. A secure, compliant, and transparent digital infrastructure of RBL combined with Bajaj finance’s pan-India reach will help customers make affordable purchases with a single platform.

OPEN is a provider of financial services for startups that enables them to manage vendor payments, billing, and accounting within their businesses using ICICI Bank APIs.

This is just the beginning of the new era of financial technology, and it will radically change how customers think about interactions with their banks. Customers are already expecting to see more than traditional financial transactions in any interaction. By incorporating embedded finance into every customer interaction, banks are better positioned to meet customer expectations in whatever way they choose.

Related: FinTech revolution: Open Banking with APIs & iPaaS

Build your FinTech tools with Quickwork

We have seen a clear shift in the banking industry to BaaS. However, many firms are still not utilizing APIs to innovate and modernize their digital services. Our goal is to help brands evolve into the digital space by providing them with access to leading BaaS providers globally and maximizing their efficiency in the digital space.

Quickwork is an API-first platform that helps banks modernize their digital offerings by providing a service-oriented approach to banking. Quickwork has been described as the "Swiss Army Knife" of banking. Our automated workflow system automates customer interactions, manages admin tasks, and streamlines compliance processes — while simultaneously increasing scalability and reducing costs.

Quickwork is the one-stop platform for building sophisticated financial applications and products. Through our APIs, we can integrate your business with multiple services from around the world. Our professional team of engineers can turn your ideas into a fully functional product with minimal effort.

To know more how Quickwork can help you, chat with us today!