Gone are the days of cumbersome paperwork and lengthy application processes that once characterized the lending landscape. We are in a world where loan applications are completed instantly via a selfie, and loan amounts are disbursed in no time.

Digital lending is revolutionizing how financial services are delivered, offering a seamless and efficient alternative to traditional lending processes. These platforms provide quick and personalised loan decisions by leveraging advanced technologies such as AI, ML, and blockchain. This digital approach not only simplifies access to credit but also enhances the overall customer experience, making it a cornerstone of modern financial services.

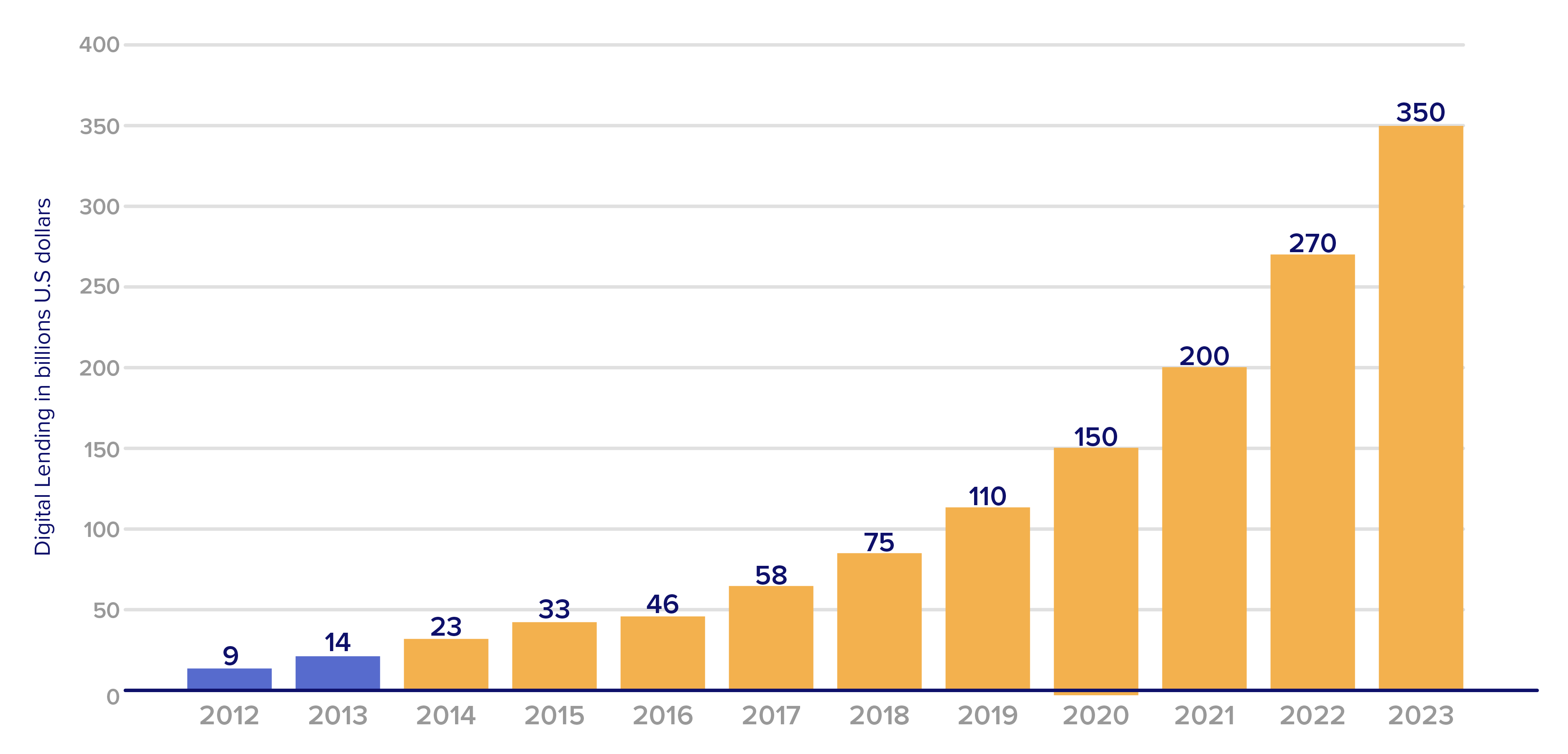

Digital lending in India is at a revolutionary stage of growth. From FY17 to FY20, digital disbursements grew by over 12 times. The total disbursements are estimated to reach more than INR47.4 lakh crore by FY26, representing a CAGR of 22%. This remarkable expansion, driven by increasing demand for financial services, high smartphone and internet penetration, socio-economic improvements, and supportive government policies, underscores digital lending’s bright future.

Value of digital lending market in India from 2012 to 2020, Source: Statista

One of the foundations of this growth has been the strategic use of integrations, which facilitate efficient data exchange and process automation, streamlining the lending experience and catalyzing the sector's rapid development.

Understanding integrations in digital lending

Integrations in digital lending refer to the technology-enabled connections between different software systems, applications, and services. These connections automate and streamline the flow of information, enhancing efficiency and the user experience in the digital lending process.

Key types of integrations

- APIs: Enable real-time communication between digital lending platforms and external financial services, facilitating credit checks, identity verification, payments, and more.

- Integrations with cloud services: Offer scalable resources for data management and analytics, crucial for handling large volumes of transactions.

- Integrations with third-party service providers: Provide specialized services like identity verification and fraud detection, which are crucial for secure and efficient operations.

The transformative impact of integrations on digital lending

Integration is transforming the lifecycle of the lending process, from application to disbursement and repayment, by automating workflows, improving risk assessment, and ensuring a smoother, faster borrower experience.

Streamlining application and underwriting

Efficient data collection and verification through integration: The adoption of integrative technologies in digital lending automates the tedious process of data collection and verification, significantly speeding up the application process. By connecting directly to financial institutions, tax databases, and employment verification services, these platforms can quickly gather and verify applicant information, reducing manual entry errors and processing times.

Advanced risk assessment with AI and ML: The heart of modern underwriting lies in the sophisticated use of AI and ML. Powered by a vast array of integrated data sources, AI and ML algorithms dissect and analyze complex patterns of financial behavior, offering a depth of risk assessment previously unattainable. This cutting-edge approach allows lenders to make informed, precise decisions quickly, and do more accurate creditworthiness evaluations. The result is a more agile, efficient underwriting process that benefits both lenders and borrowers.

Enhancing credit decisioning

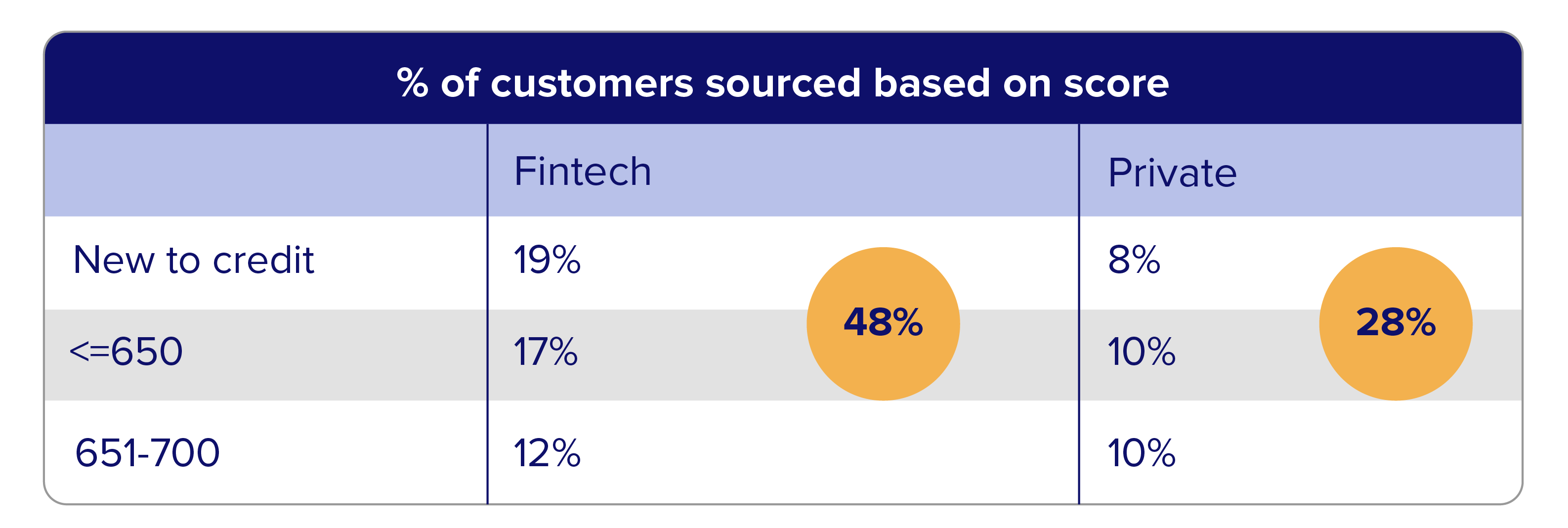

Integrations with credit bureaus and alternative data sources: Digital lending platforms integrate with credit bureaus to access traditional credit reports and scores. Also, by leveraging alternative data sources such as utility and rental payments history, and social media activity, lenders can get a holistic view of an applicant's financial behavior and creditworthiness. This comprehensive approach gives a deeper understanding of potential borrowers, especially those with thin credit files or no traditional credit history.

FinTechs source a higher share of NTC and customers with credit scores <700, Source: Next phase of digital lending in India

Leveraging integrated data for informed credit decisions: Diverse data sources provide lenders with a rich dataset to make more informed credit decisions. This data-driven approach reduces the risk of defaults by identifying reliable borrowers who might have been overlooked by traditional credit scoring models. Furthermore, it enables lenders to offer more competitive and personalized loan products, as they can more accurately price the risk associated with each loan.

Personalized customer experience

Personalized loan products: Data integration allows lenders to tailor loan products to individual needs, improving customer satisfaction. By understanding a borrower's financial situation and preferences, lenders can offer personalized terms such as flexible repayment schedules, interest rates, and loan amounts.

Faster loan disbursement and flexible repayments: Banking API integrations enable instant loan disbursement after approval, while integrated payment gateways and digital wallets offer diverse repayment options, promoting financial management and loyalty.

Broadening access to credit

Integration with non-traditional data sources: By using non-traditional data for credit assessment, lenders can extend credit to underserved or unbanked populations. This approach democratizes access to financial services, allowing those without a formal credit history to receive loans based on alternative indicators of creditworthiness.

Fostering financial inclusion: The use of integrations to evaluate creditworthiness beyond traditional credit scores is a significant step towards financial inclusion. It opens up opportunities for a larger population to access financial products, contributing to economic empowerment and growth. Only 10% of individuals and 14% of India’s MSMEs have access to formal credit. Digital lending platforms hold a high potential to bridge this gap.

Leveraging ecosystem partnerships for expanded services

Expansion of financial product ranges: Through integrations, digital lending platforms can easily partner with banks, fintech startups, and other financial service providers to offer a broader range of products and services. This ecosystem approach enables customers to access a one-stop-shop for their financial needs, from loans to insurance and investment products.

Unified financial services experience: By integrating various financial services onto a single platform, customers can enjoy the convenience of managing loans, insurance policies, and investment portfolios through a unified interface. This strategy boosts both customer satisfaction and loyalty, while also establishing the platform as a pivotal presence in users' financial activities.

Ensuring security and compliance

Integrations with security and regulatory solutions: Digital lending platforms integrate with advanced security solutions and regulatory compliance tools to protect customer data and ensure secure transactions. These integrations help maintain high data integrity standards and compliance with financial regulations.

Automated KYC and AML checks: By integrating with governmental and third-party databases, lenders can automate KYC (Know Your Customer) and AML (Anti-Money Laundering) checks. This speeds up the verification process, reduces cost, and enhances the accuracy and reliability of compliance checks, reducing the risk of fraud. Aadhaar-based digital verification system has brought down the cost of KYC to ₹3 from as high as ₹700. The cost of loan processing has been lowered by almost 75 per cent.

Customer service and support

Enhanced service quality: The integration of CRM systems, chatbots, and support software improves the quality and responsiveness of customer service. Real-time access to customer data and loan information enables personalized support and efficient problem resolution, increasing customer satisfaction.

Integrated feedback systems: Feedback systems integrated with the lending platform allow for the continuous improvement of services based on real-time data and customer feedback. This dynamic approach to customer service fosters an environment of constant enhancement, ensuring that services remain aligned with customer needs and expectations.

Benefits of integrations in digital lending

Integrations within digital lending platforms significantly enhance the efficiency and effectiveness of financial services. By seamlessly connecting disparate systems, applications, and third-party services, integrations facilitate a streamlined operational framework that is both agile and robust. Here are key benefits, along with added insights into how they transform the lending landscape:

Enhanced efficiency through automation

Integrations automate crucial processes such as data collection, verification, and loan processing. This automation not only minimizes manual labor but also accelerates the entire lending cycle, from application to disbursement.

Data-driven decision making

Access to a wider range of data sources allows for more comprehensive credit assessments. Integrations with credit bureaus, financial institutions, and even non-traditional data sources enable a more accurate understanding of a borrower's creditworthiness.

Improved customer experience

A seamless and quick loan application process, enabled by integrations, significantly enhances user satisfaction. Customers benefit from faster responses and personalized loan offers based on a detailed analysis of their financial behavior.

Increased security and compliance

By integrating with advanced security protocols and compliance tools, digital lending platforms can better protect sensitive information and adhere to regulatory standards. This ensures a safer environment for both lenders and borrowers.

Scalability and flexibility

Cloud-based integrations offer digital lending platforms the ability to scale operations up or down as needed, without significant upfront investments in infrastructure. This flexibility supports growth and adaptation in a rapidly changing market.

Cost reduction

Streamlining operations through integrations leads to significant cost savings. By reducing manual tasks and optimizing processes, lenders can lower operational costs and pass these savings onto customers through lower fees or interest rates.

The future of lending is definitely digital

The trajectory toward digital lending is a fundamental shift in the financial landscape. As technology continues to advance, the future of lending undoubtedly lies in digital solutions. This evolution promises a more efficient, accessible, and customer-centric approach to financial services, where decisions are faster, processes are streamlined, and security is enhanced.

Key factors differentiating digital lending from traditional lending, Source: Next phase of digital lending in India

By embracing digital lending, the industry is set to offer unprecedented levels of convenience and personalization, catering to the evolving needs of modern consumers. As we move forward, the integration of innovative technologies in lending practices will further democratize access to financial services, making the future of lending not only digital but also more inclusive and empowering for all.