The banking industry has been constantly evolving to incorporate technology and provide consumers with the best possible features. With the ever-increasing prominence of digital banking, the spotlight is now on open banking and its capabilities for changing the global landscape of banking and finance.

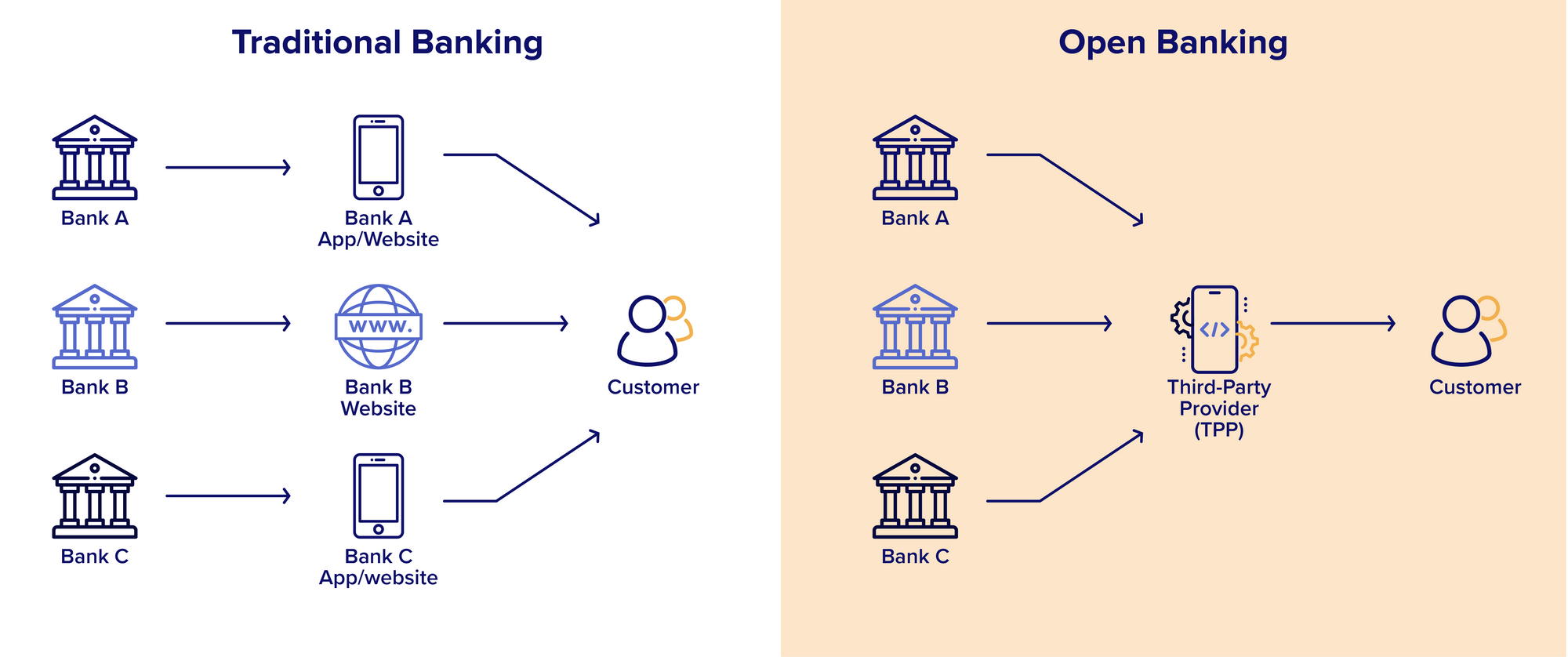

Open banking is the practice of sharing consumers' banking and transaction information, along with other financial data, with third-party financial service providers through Application Programming Interfaces (APIs).

First and foremost, customers must grant the bank access to share their data securely by selecting a checkbox and accepting certain terms and conditions on digital apps. Once approved by the customer, banks allow third parties, such as technology start-ups and online financial service vendors, to access customer data ranging from customer account details to transaction history.

Related read: Open banking APIs: Enabling fintech collaboration in India

The power of open banking

Open banking not only provides customers’ data to service companies but also opens the possibility of using this information to gain insights and drive actions.

Personalized suggestions for improved customer retention

By accessing customer transaction data across multiple platforms, it is possible to identify the best financial products and services for them. A new savings account that earns a higher interest rate than their current savings account or a different credit card with a lower interest rate are some of the possible suggestions that will enable customers to make informed decisions.

Understanding risk appetite

Open banking could help banks and lending organizations to get a more accurate picture of a consumer's financial situation and risk appetite. This ensures that more profitable loan options can be suggested while giving consumers an accurate picture of their finances before taking on debt. An open banking app for customers who want to buy a home could automatically calculate what customers can afford based on all the information in their accounts, perhaps providing a more reliable picture than mortgage lending guidelines currently provide.

Inclusive features

Traditionally, financial data resides within banking institutions and very few of them have digital apps which have interfaces that are flexible enough to be used by differently abled customers. Open banking gives technology companies the opportunity to explore how to make inclusive applications that provide user interfaces with voice commands and simplistic navigation. This empowers differently-abled individuals to better understand their finances independently.

Driving innovation

Since smaller banks and FinTech utilize open banking to develop third party services that focus on lower costs and increased customer engagement, it will force established banks to be more competitive. Established banking institutions can no longer simply facilitate transactions. They will have to actively be involved in adopting new technology and developing innovative ways to enable their customers to plan and manage their finances.

Faster support for small businesses

Loan approval processes for small companies tend to be long and cumbersome. Lending organizations review the company's account and financial statements before making a decision. Open banking enables lenders to pull and analyze data from the banking and accounting systems in real time, which expedites the process. While any submitted reports can become outdated by the time of review, real-time data ensures that only the most updated financial situation of the company is under review.

The future of open banking

Open banking and APIs are increasingly becoming the driving factors leading to innovation in fintech in the upcoming years. Their benefits will serve not just banks and third-party vendors but also consumers worldwide by giving them a plethora of options for managing their finances.

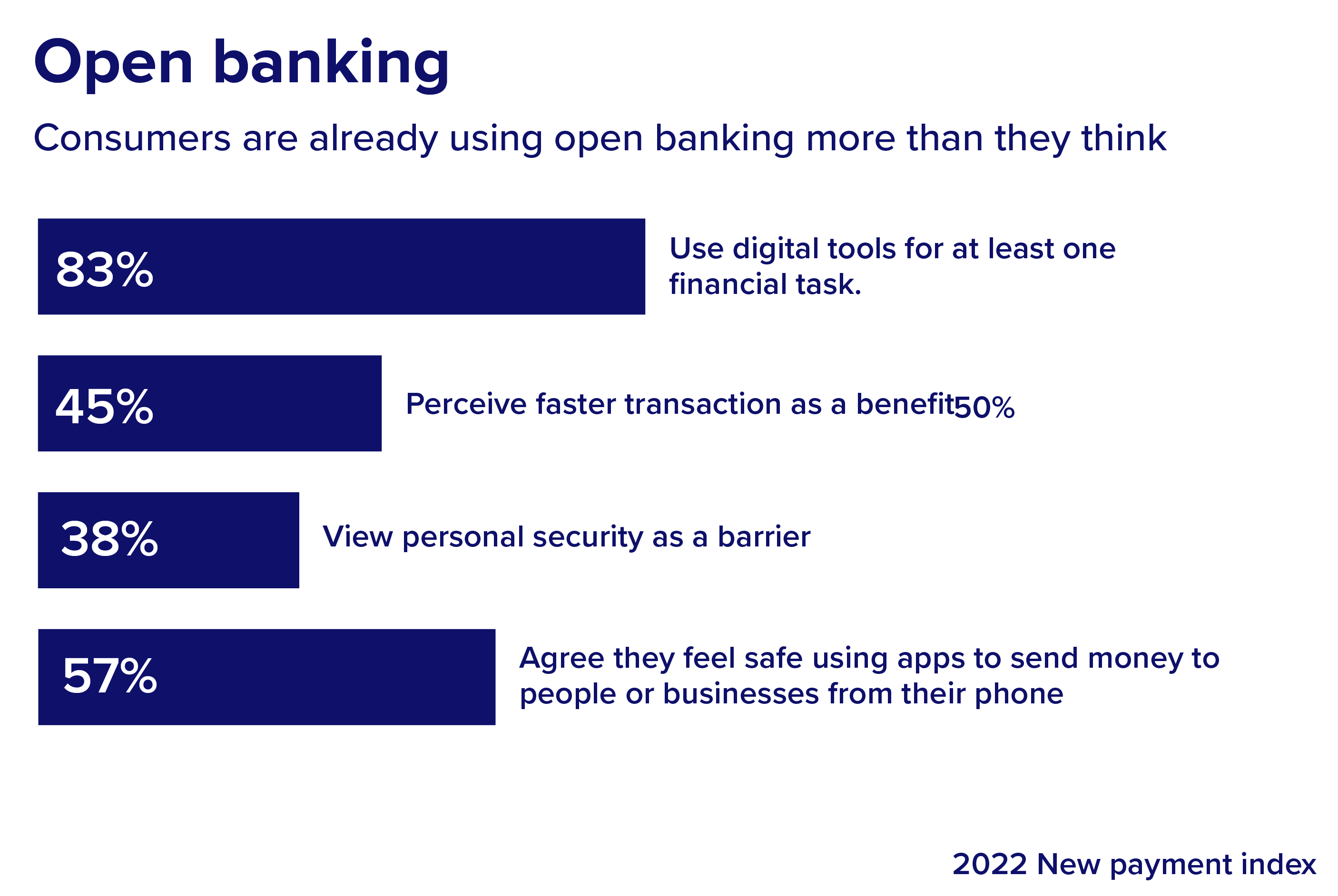

According to Mastercard's 2022 New Payments Index, more than 80% of survey participants use digital tools for at least one financial task.

Enhancing banking services, empowering consumers’ understanding of finance, enabling banks to scale more freely and function in real-time, reducing the liability on physical institutions, and simplifying the process of uploading and processing financial records are just a few of the many promises that open banking has to offer.

As the open banking space evolves, it is imperative to stay educated about the power of data and how businesses can incorporate it to reshape the banking industry's competitive landscape.

Open banking is a gateway to endless opportunities. Step into the future of FinTech with Quickwork and create a customized business workflow that paves the way to the future.